The Best Strategy To Use For Health Insurance

Wiki Article

8 Simple Techniques For Renters Insurance

Table of ContentsThings about Health InsuranceLittle Known Questions About Renters Insurance.Some Known Questions About Renters Insurance.The Ultimate Guide To Cheap Car Insurance

You Might Want Disability Insurance Coverage Too "Unlike what several people assume, their home or car is not their greatest asset. Rather, it is their capacity to gain an earnings. Many experts do not insure the possibility of a handicap," stated John Barnes, CFP and owner of My Family Life Insurance Coverage, in an e-mail to The Balance.

The information listed below focuses on life insurance coverage offered to people. Term Term Insurance policy is the easiest kind of life insurance.

The expense per $1,000 of advantage boosts as the insured person ages, as well as it clearly obtains really high when the insured lives to 80 and also beyond. The insurance provider might charge a costs that increases every year, however that would make it extremely hard for most people to manage life insurance coverage at innovative ages.

The Only Guide for Life Insurance

Insurance plan are created on the concept that although we can not quit unfavorable occasions occurring, we can shield ourselves monetarily against them. There are a large variety of various insurance policy policies offered on the market, and also all insurance providers attempt to encourage us of the qualities of their particular product. A lot to make sure that it can be hard to choose which insurance policy policies are actually essential, and which ones we can genuinely live without.Researchers have actually located that if the primary wage earner were to die their household would only be able to cover their household expenditures for simply a couple of months; one in 4 family members would certainly have troubles covering their outgoings instantly. The majority of insurance companies recommend that you take out cover for around 10 times your yearly earnings - life insurance.

You ought to also consider child care expenditures, as well as future university costs if applicable. There are two major kinds of life insurance coverage policy to pick from: entire life policies, as well as term life policies. You spend for entire life plans up until you die, and you pay for term life policies for a collection amount of time identified when you secure the plan.

Medical Insurance, Medical Insurance is one more among the four main sorts of insurance that experts advise. A recent research disclosed Read More Here that sixty 2 percent of individual bankruptcies in the United States in 2007 were as a straight outcome of wellness issues. An unusual seventy eight percent of these filers had health insurance coverage when their ailment started.

Little Known Facts About Health Insurance.

Costs differ significantly according to your age, your existing state visit our website of wellness, and your way of living. Car Insurance coverage, Laws differ in between different countries, but the significance of auto insurance stays consistent. Also if it is not a legal need to obtain automobile insurance coverage where you live it is very advised that you have some kind of policy in position as you will still need to presume financial responsibility in the instance of a crash.Additionally, your car is commonly one of your most important assets, and if it is damaged in a crash you might have a hard time to spend for repair services, or for a replacement. You could also locate on your own accountable for injuries sustained by your travelers, or the vehicle driver of one more vehicle, and for damage triggered to an additional car as a result of your negligence.

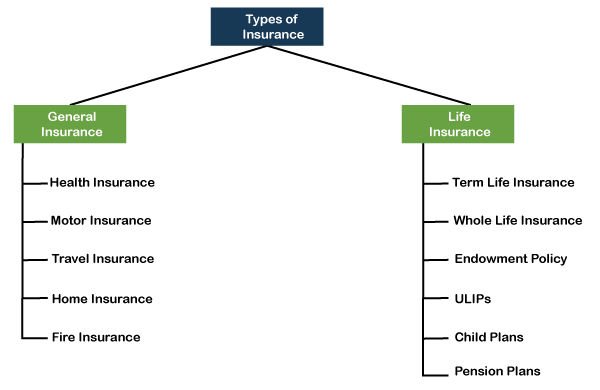

General insurance covers house, your traveling, vehicle, as well as wellness (non-life possessions) from fire, floods, crashes, synthetic disasters, as well as burglary. Different sorts of basic insurance policy consist of motor insurance coverage, medical insurance, traveling insurance coverage, as well as house insurance policy. A general insurance plan spends for the losses that are incurred by the guaranteed throughout the period of the policy.

Keep reading to know more about them: As the residence is an important possession, it is necessary to secure your residence with an appropriate. Residence and also house insurance policy protect your residence and also the things in it. A residence insurance plan basically covers man-made and natural conditions that may cause damages or loss.

The Of Medicaid

When your vehicle is accountable for an accident, third-party insurance coverage takes care of the harm created to a third-party. It is additionally essential to note that third-party electric motor insurance is required as per the Electric Motor Autos Act, 1988.

A hospitalization expenses as much as the sum guaranteed. When it concerns medical insurance, one can go check it out with a standalone wellness plan or a household floater strategy that provides insurance coverage for all relative. Life insurance policy gives insurance coverage for your life. If a circumstance takes place wherein the policyholder has an early death within the term of the policy, then the candidate obtains the amount assured by the insurer.

Life insurance policy is different from basic insurance on numerous parameters: is a temporary agreement whereas life insurance policy is a lasting contract. When it comes to life insurance policy, the benefits as well as the sum guaranteed is paid on the maturation of the policy or in case of the plan holder's death.

The general insurance coverage cover that is mandatory is third-party liability car insurance coverage. Each as well as every type of basic insurance cover comes with a goal, to supply protection for a specific element.

Report this wiki page